As that scenario may be very unlikely to happen, projected APR should be taken by using a grain of salt. In the same way, all fees are by now abstracted from this number.

PoolA recieves new depositors & new TVL , new depositors would straight away get their share of this harvested rewards.

3. Enter the amount of LP tokens you want to to stake. If it is your first time using the platform, you'll need to approve your LP tokens for use With all the deal by pressing the "Approve" button.

Vote-locked CVX is employed for voting on how Convex Finance allocates It is really veCRV and veFXS in the direction of gauge pounds votes and also other proposals.

Whenever you deposit your collateral in Convex, Convex functions as a proxy so that you can obtain boosted benefits. In that method Convex harvests the rewards and after that streams it for you. Due safety and gasoline reasons, your benefits are streamed to you personally in excess of a seven working day period following the harvest.

Convex has no withdrawal service fees and small general performance service fees that is accustomed to buy gas and distributed to CVX stakers.

Inversely, if buyers unstake & withdraw from PoolA within this 7 day timeframe, they forfeit the accrued rewards of previous harvest to the rest of the pool depositors.

CVX tokens were being airdropped at launch to some curve consumers. See Claiming your Airdrop to find out if you have claimable tokens from start.

CVX is rewarded to CRV stakers and Curve.fi liquidity pools pro-rata to CRV generated with the System. If you're within a superior CRV rewards liquidity pool you are going to get extra CVX to your endeavours.

Crucial: Converting CRV to cvxCRV is irreversible. You could possibly stake and unstake cvxCRV tokens, but not change them back to CRV. Secondary markets having said that exist to enable the Trade of cvxCRV for CRV at different market prices.

3. Enter the amount of LP tokens you would like to stake. Whether it is your initially time using the platform, you will have to approve your LP tokens to be used Using the contract by urgent the "Approve" button.

This generate relies on the many at this time Energetic harvests that have by now been termed and so are now becoming streaming to Lively members while in the pool above a seven day period from convex finance The instant a harvest was referred to as. Whenever you sign up for the pool, you are going to quickly get this generate for each block.

Convex enables Curve.fi liquidity suppliers to make investing charges and declare boosted CRV without having locking CRV them selves. Liquidity providers can get boosted CRV and liquidity mining benefits with minimum effort and hard work.

When staking Curve LP tokens to the platform, APR quantities are displayed on Each and every pool. This web site describes Each individual amount in a bit additional element.

This is the yield proportion that is certainly currently getting produced via the pool, according to The present TVL, latest Curve Gauge boost that is certainly Lively on that pool and benefits priced in USD. If all parameters continue to be the exact same for a couple of weeks (TVL, CRV Improve, CRV rate, CVX cost, prospective 3rd social gathering incentives), this tends to ultimately become The existing APR.

Transform CRV to cvxCRV. By staking cvxCRV, you’re earning the same old benefits from veCRV (crvUSD governance rate distribution from Curve + any airdrop), plus a share of 10% from the Convex LPs’ boosted CRV earnings, and CVX tokens on top of that.

Due this 7 working day lag and its consequences, we make use of a Latest & Projected APR building this difference clearer to people and established obvious expectations.

If you want to stake CRV, Convex lets buyers acquire buying and selling costs as well as a share of boosted CRV obtained by liquidity providers. This allows for a better balance between liquidity providers and CRV stakers and improved cash performance.

This can be the -recent- net produce percentage you're going to get on your own collateral if you find yourself while in the pool. All charges are already subtracted from this range. I.e. Should you have 100k in the pool with 10% current APR, You will be getting 10k USD worth of benefits each year.

Edward Furlong Then & Now!

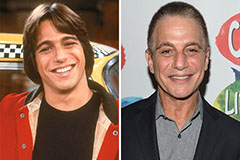

Edward Furlong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!